It’s the question that keeps older people up at night: Will the recommended $1 million in retirement savings actually be enough?

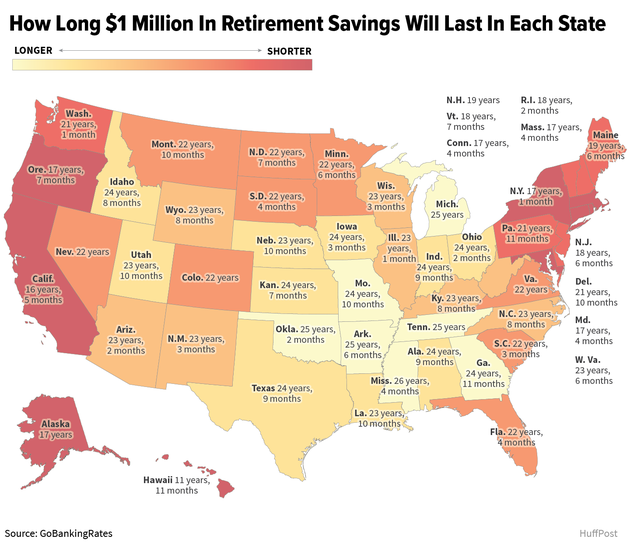

The answer depends in part on where you live, according to a new GOBankingRates study.

The $1 million figure is thrown around by AARP and others as the amount of savings needed to replace between 70 percent and 80 percent of a person’s work income. But that’s a rough estimate and there are a lot of variables in retirement planning: How large is that income you hope to replace? How long will you live? Should you count your home equity as part of your savings if you’re not planning on selling your home? How will taxes and investment returns affect your retirement income? How will inflation affect your expenses? What happens if you suffer a sudden or long-term incapacitating illness?

The reality is that few retirees have saved anything close to $1 million. A 2016 BlackRock survey found that the average baby boomer between the ages of 55 and 65 had saved only $136,000 for retirement.

That means many people will need to stretch their savings and maybe relocate to the states where their money could last the longest.

GOBankingRates, a personal finance website, pegged Mississippi at the top of the list: In that state, $1 million could cover the needs of the average retiree for 26 years, 4 months. Hawaii is where you’re likely to blow through those savings the fastest ― in 11 years, 11 months.

The website determined the average total annual expenses for people 65 and older (counting groceries, housing, utilities, transportation and health care) and then multiplied total expenses by each state’s cost-of-living index to calculate the state-specific yearly cost. Housing is generally the big ticket item.

The U.S. Census puts the average retirement age at 63. At age 65, Americans’ average life expectancy is about 19 more years. So that leaves you with two decades during which savings, pensions, home equity and Social Security become your principal means of financial support.

If you’ve managed to sock away $1 million, here are the five states where GOBankingRates says it will last the longest:

- Mississippi (26 years, 4 months)

- Arkansas (25 years, 6 months)

- Oklahoma (25 years, 2 months)

- Michigan (25 years)

- Tennessee (25 years)

And the seven states where it will disappear the fastest:

- Hawaii (11 years, 11 months)

- California (16 years, 5 months)

- Alaska (17 years)

- New York (17 years, 1 month)

- Connecticut (17 years, 4 months)

- Maryland (17 years, 4 months)

- Massachusetts (17 years, 4 months)

How did your state fare? Check it out on the map below.